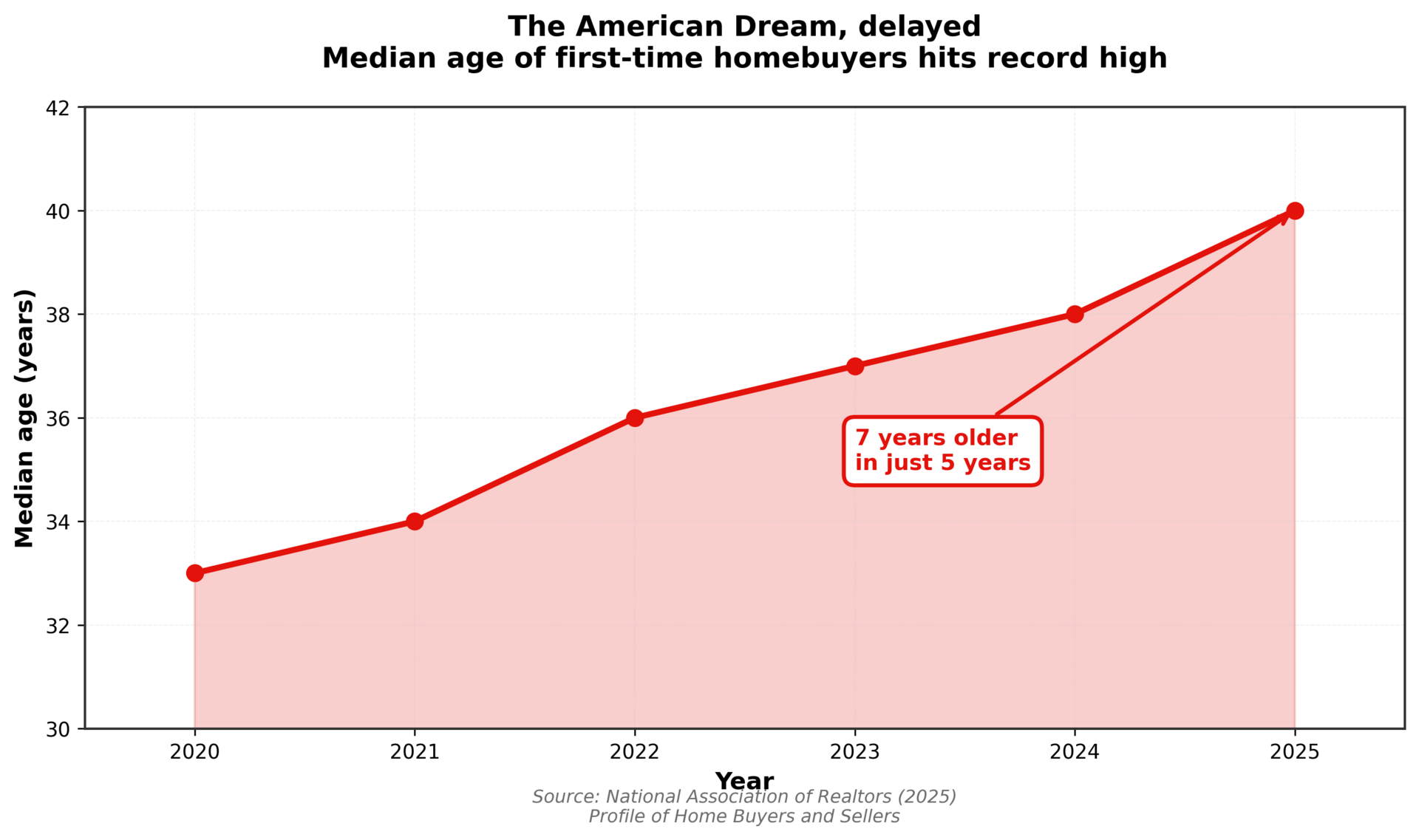

First-time homebuyers now reach 40 before purchasing. The consequences extend far beyond housing.

The average first-time homebuyer is now 40 years old, a full seven years older than in 2020. This is a by-product of a foundational shift in wealth accumulation, family formation, and economic mobility. When people must wait until middle age to achieve what their parents managed in their twenties, something has broken.

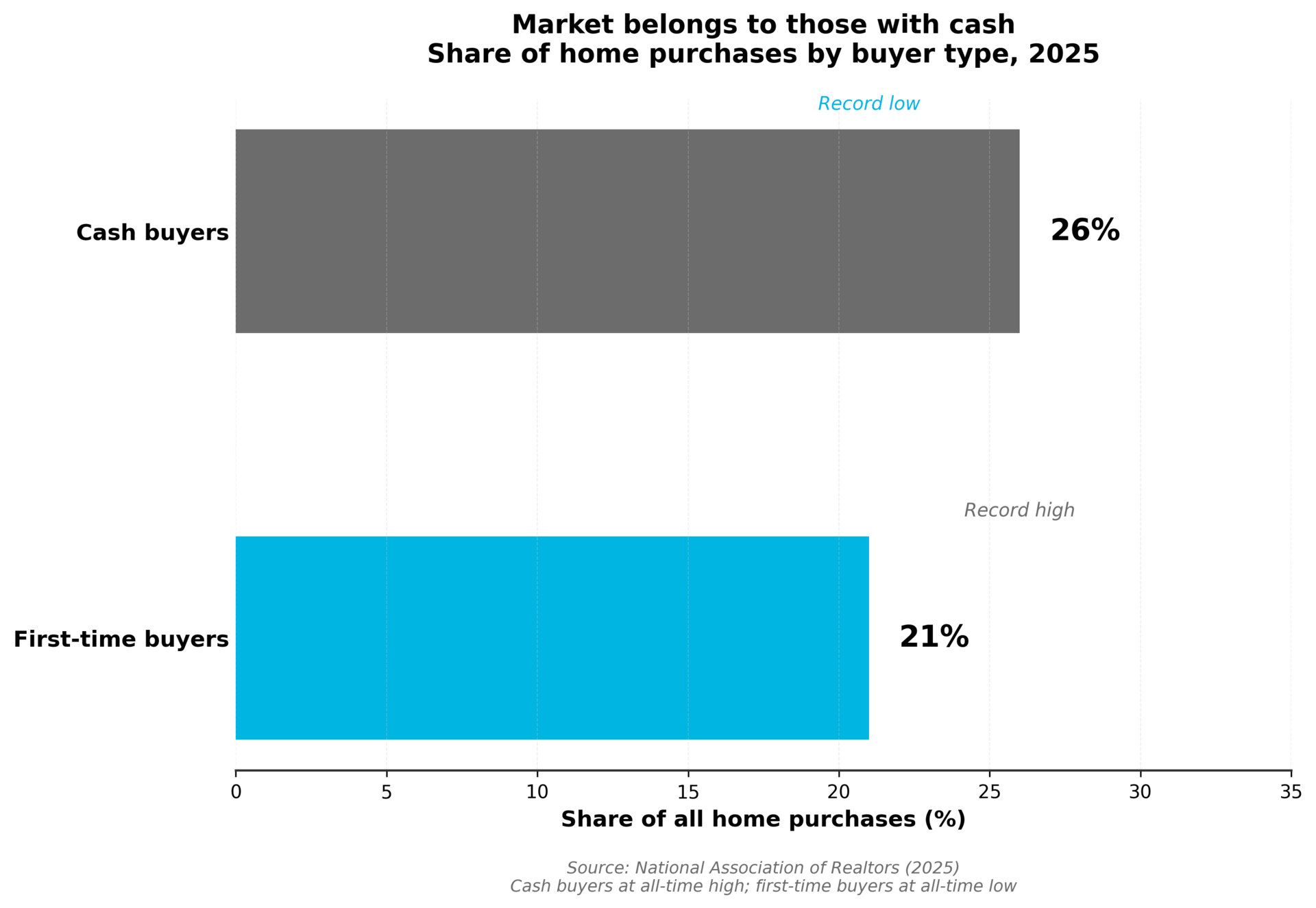

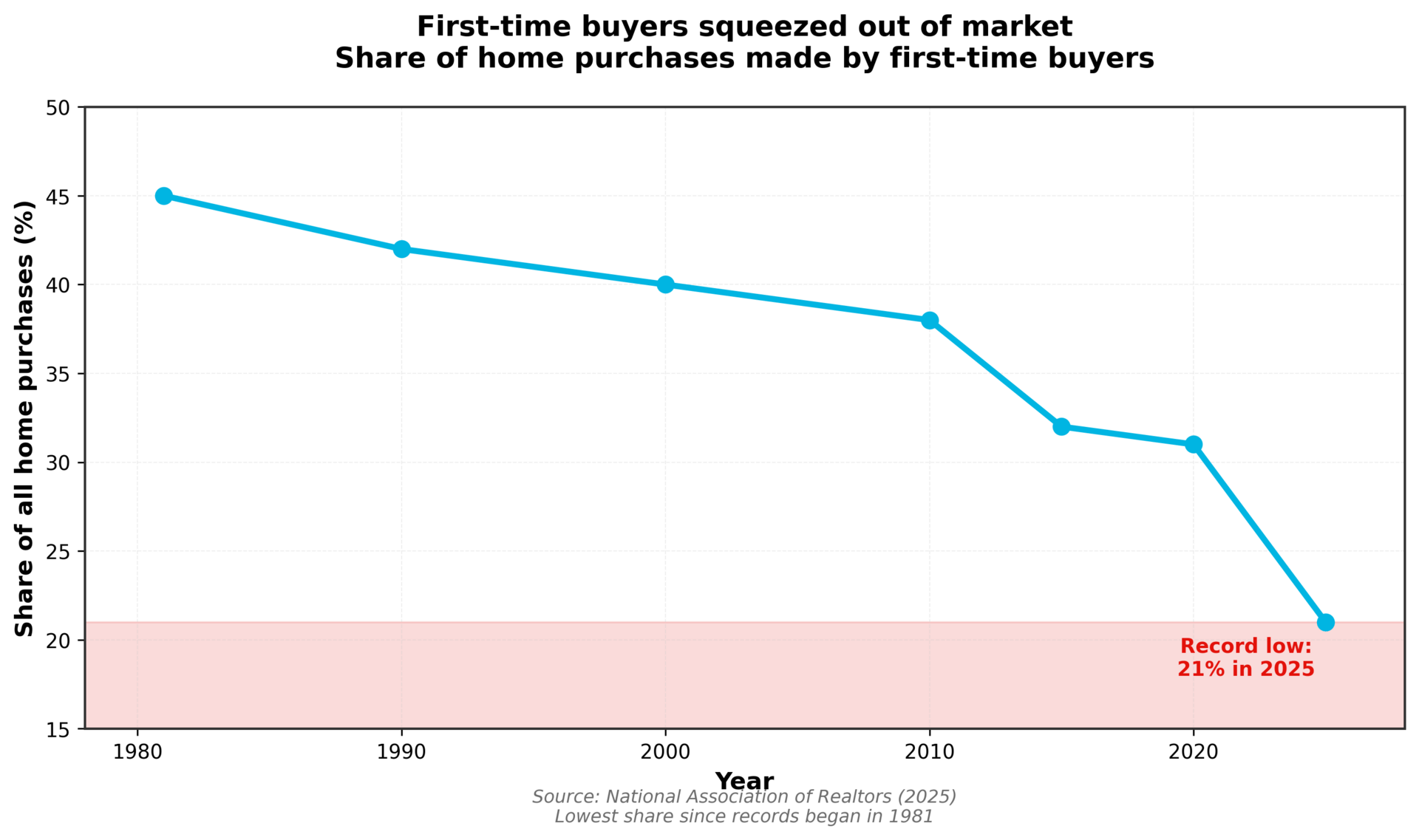

The numbers tell a worrying story. First-time buyers comprised just 21% of all home purchases in 2025, the lowest share since records began in 1981, according to the National Association of Realtors. Meanwhile, cash buyers reached an all-time high of 26%. The market increasingly belongs to those who already own property, not those seeking to enter it.

The median first-time buyer now earns $94,400, well above the national median income of $81,604. Yet even these relatively high earners must scrape together a 10% down payment, the largest share since 1989. The math is unforgiving. With median home prices at record highs and mortgage rates above 6%, monthly payments consume an ever-larger portion of income.

Those forced to delay homeownership pay a steep price. Buying at 40 rather than 30 costs roughly $150,000 in lost equity on a starter home, according to the NAR. The wealth gap compounds across generations. Parents with less home equity cannot help their children with down payments, perpetuating a cycle where homeownership becomes increasingly concentrated among those who already have it.

The root cause sits with supply. Construction of flats and small homes, the traditional entry points for first-time buyers, collapsed during the pandemic as builders focused on larger suburban properties. Permits for multi-family construction in cities like San Francisco fell to half their pre-pandemic levels in 2020. Many projects begun during the boom now sit unfinished, luxury shells mocking those priced out of the market.

Regulatory barriers compound the shortage. Zoning restrictions limit where new housing can be built. Environmental reviews delay projects for years. Local opposition blocks development near existing neighborhoods. These obstacles, often justified in the name of community preservation, effectively pull up the ladder behind those who already own property.

The demographic consequences extend well beyond housing. The share of homebuyers with children under 18 has fallen to 24%, an all-time low. Among those with children, 21% cite childcare costs as a barrier to saving for a down payment. Delaying homeownership means delaying family formation, which means fewer children born to each generation. A society that makes it difficult to own a home makes it difficult to raise a family.

Repeat buyers face none of these constraints. The typical repeat buyer is now 62, also a record high. These buyers, many approaching retirement, paid cash 30% of the time and put down a median of 23% when financing. They benefit from substantial equity accumulated over decades of ownership and favorable tax treatment of capital gains on primary residences.

The political implications deserve attention. A nation divided between property owners and permanent renters creates fundamentally different interests. Homeowners vote for policies that raise property values, even if those same policies price out new buyers. Renters lack the stability and wealth accumulation that homeownership provides, leaving them more dependent on government support and less able to weather economic disruption.

Some argue recent trends offer hope. Mortgage rates have fallen to 6.17%, a one-year low. Home price growth has weakened, with prices falling in several Southern and Western markets. Inventory continues to rise. Yet these modest improvements must overcome years of underbuilding and regulatory barriers that show no signs of easing.

The solution requires confronting uncomfortable truths. Wealthy homeowners in desirable areas benefit from restricted supply that inflates their property values. Local governments collect higher tax revenues from expensive homes. Incumbent residents resist the construction and density that would make housing affordable for newcomers. These incentives align against the young families trying to enter the market.

America once promised that hard work and modest means could secure a family home. That promise now rings hollow for those earning above the national median yet still unable to afford entry into homeownership before middle age. Restoring it requires action to dramatically increase housing supply where people want to live. The question is whether those who already own property will allow it.

Real Estate News:

— Real Estate Investing Intelligence

Disclaimer: This newsletter is for educational purposes only and is not financial, investment, tax, legal, or accounting advice. I'm not a CPA, tax professional, financial advisor, investment advisor, broker-dealer, attorney, or any licensed professional. My content reflects personal opinions and research that should never be your sole basis for financial decisions. Tax laws and regulations are complex, change frequently, and vary by jurisdiction and individual circumstances. Before making any financial, investment, or tax decisions, consult qualified licensed professionals in your jurisdiction and conduct independent research. I make no representations or warranties about accuracy, completeness, or reliability of any information provided. All content is "as is" without warranties of any kind. You use this newsletter entirely at your own risk. I disclaim all liability for any losses, damages, costs, or expenses arising from your use of this information, including direct, indirect, incidental, consequential, or punitive damages. Past performance doesn't guarantee future results, all investments carry risk and may lose value, and tax situations are highly individual. Nothing here creates an advisor-client relationship. By reading this newsletter, you agree to these limitations, will seek appropriate professional advice before taking action, and agree to hold me harmless and indemnify me from any claims or damages arising from your use of this information.