A proposal to impose two-year limits on housing vouchers would displace 3.3 million people. Most have jobs.

In a nation with 650,000 people sleeping rough on any given night, federal rental assistance serves as a critical bulwark against homelessness. Yet the Trump Administration wants to impose a strict two-year limit on housing aid, regardless of whether recipients can afford rent when their time runs out. If enacted, the policy would cut off assistance to 3.3 million Americans, more than half of them children.

The proposal sits within a broader plan to consolidate five rental assistance programs into a state block grant with sharply reduced funding. While Congress shows little appetite for the block grant this year, the Department of Housing and Urban Development reportedly plans to advance time limits through regulation. Legal challenges seem inevitable, given HUD lacks clear authority to impose such sweeping changes without congressional approval.

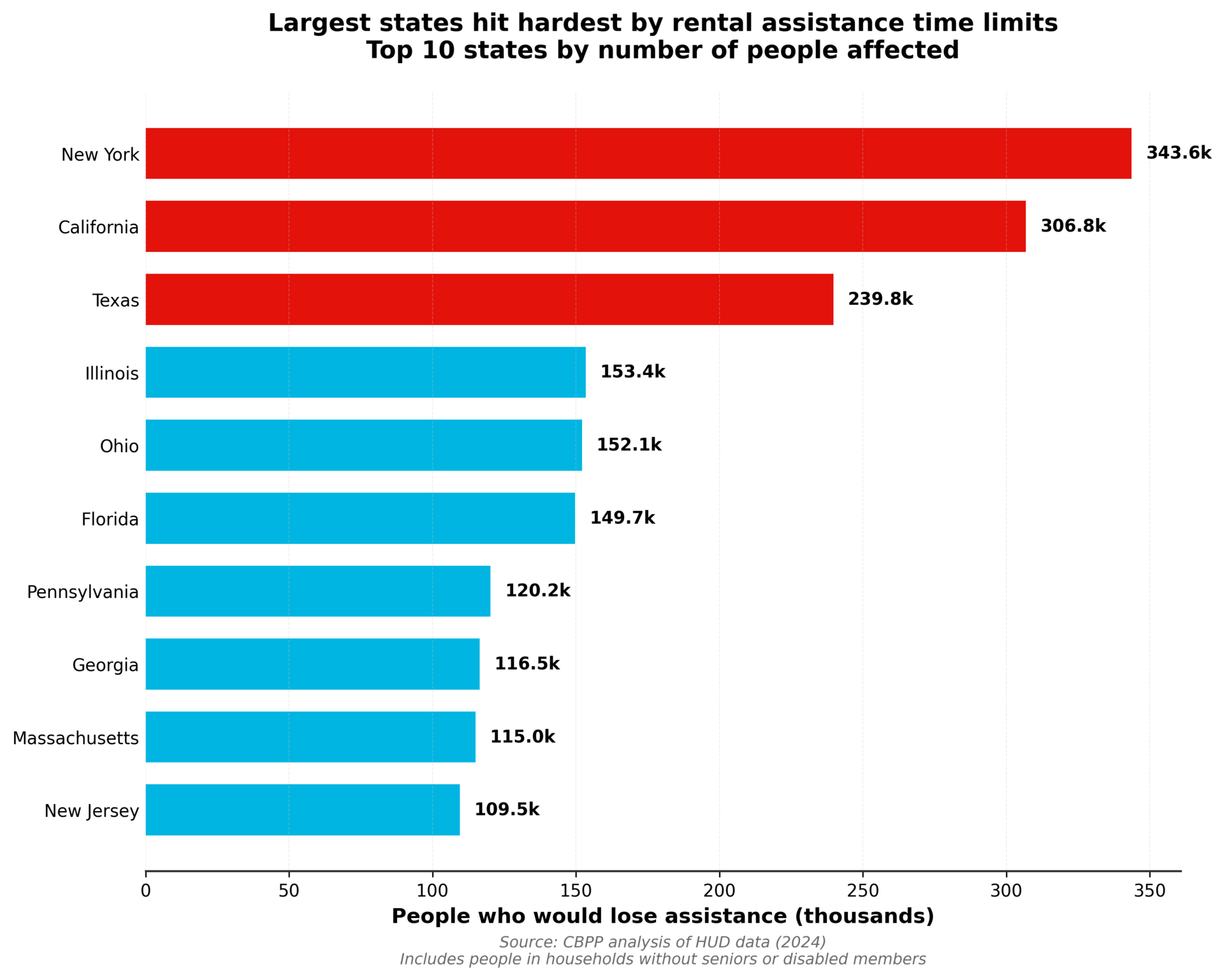

The arithmetic is stark. Of the 9 million people currently receiving federal rental assistance, 3.3 million live in households without seniors or disabled members. Under the proposed time limit, every one of them would lose their voucher after two years. Nearly 2 million of these people belong to working households where wages simply do not stretch far enough to cover market rents.

This reflects a broader reality in American housing markets. Fewer than half of all workers earn enough to afford a modest one-bedroom flat working 40 hours weekly, according to the National Low-Income Housing Coalition. When assistance ends, displaced families will not suddenly earn more or find cheaper housing. They will more likely join the swelling ranks of the homeless.

Research on time-limited assistance offers a grim preview. One study randomly assigned homeless families with children to three groups: those offered ongoing need-based assistance, those offered 18-month limited aid, and those offered no additional help. By year three, families in the time-limited group fared no better than those who received nothing at all. The share who were homeless or doubled up reached twice the rate of families with ongoing assistance.

The political calculus behind time limits rests on a seductive logic. Only one in four eligible households currently receives rental assistance, with waiting lists stretching years in most cities. Why not rotate aid among struggling families rather than letting some receive help indefinitely?

Yet this musical chairs approach ignores what makes rental assistance effective. Stability matters. Children whose families receive vouchers show lower rates of foster care placement and behavioral problems. Those who use vouchers to move to lower-poverty neighborhoods attend college at higher rates and earn more as adults. These benefits accumulate over time and vanish when families face eviction every two years.

The Administration claims to want more recipients working, but its proposal achieves the opposite. Workers who lose stable housing miss shifts while relocating belongings and caring for displaced children. Many cannot hold jobs without a permanent address. The 2 million workers who would lose assistance under time limits hardly fit the stereotype of able-bodied adults lounging on government support.

Proponents might point to work requirements as a solution, but housing agencies and subsidized property owners would shoulder new burdens. They must now track employment status, impose arbitrary deadlines, and evict stably housed families every 24 months. Private landlords, meanwhile, may grow reluctant to accept vouchers if federal payments prove unreliable. This would shrink housing options for voucher holders, particularly in safer, lower-poverty areas where research shows the greatest benefits for children.

Congressional Republicans are advancing complementary proposals. A House Appropriations Committee bill cuts public housing funding while giving HUD sweeping authority to let agencies raise rents without limits. This creates a backdoor time limit, since agencies could raise rents so high after two years that families receive no effective assistance. The Senate Banking Committee may soon consider expanding the Moving to Work program, which already permits 139 housing agencies to impose time limits and work requirements. The proposed expansion would extend these policies to most or all of America's 3,600 housing agencies.

The demographic impact would fall hardest on communities already facing housing discrimination. Black and Latino families comprise a disproportionate share of rental assistance recipients, reflecting longstanding barriers in housing markets. Of the 1.7 million children who would lose assistance under time limits, most belong to these communities.

America faces no shortage of wealth to house its struggling families. The choice to impose arbitrary time limits reflects priorities, not constraints. Policymakers who genuinely support work would expand rental assistance and invest in child care and job training rather than pulling support from working families. The question is not whether America can afford to help 3.3 million people keep their homes. It is whether policymakers will choose to do so. []

Real Estate Investing News:

— Real Estate Investing Intelligence

Disclaimer: This newsletter is for educational purposes only and is not financial, investment, tax, legal, or accounting advice. I'm not a CPA, tax professional, financial advisor, investment advisor, broker-dealer, attorney, or any licensed professional. My content reflects personal opinions and research that should never be your sole basis for financial decisions. Tax laws and regulations are complex, change frequently, and vary by jurisdiction and individual circumstances. Before making any financial, investment, or tax decisions, consult qualified licensed professionals in your jurisdiction and conduct independent research. I make no representations or warranties about accuracy, completeness, or reliability of any information provided. All content is "as is" without warranties of any kind. You use this newsletter entirely at your own risk. I disclaim all liability for any losses, damages, costs, or expenses arising from your use of this information, including direct, indirect, incidental, consequential, or punitive damages. Past performance doesn't guarantee future results, all investments carry risk and may lose value, and tax situations are highly individual. Nothing here creates an advisor-client relationship. By reading this newsletter, you agree to these limitations, will seek appropriate professional advice before taking action, and agree to hold me harmless and indemnify me from any claims or damages arising from your use of this information.